Services

The EverestPrime Funds Forex offering is one of the most competitive in the world. Access the world’s largest and most liquid market with Raw spreads starting from 0.0 pips.

Get Started What is Forex Trading?

What is Forex Trading?

Forex (FX) market is a global electronic network for currency trading. It has no central physical location, yet the forex market is the largest, most liquid market in the world by trading volume, with trillions of dollars changing hands every day. Most of the trading is done through banks, brokers, and financial institutions.

Foreign exchange trading involves trading one currency pair against another, predicting that one currency will rise or fall against another. Currencies are traded in pairs, like the Euro versus the US Dollar (EUR/USD).

So, you’re looking to learn the basics, perhaps even get a detailed understanding of Forex Trading. Well, you’ve come to the right place! In this guide, we’ll be addressing all of the important things that you need to know before you start forex trading in order to understand how to enter the markets safely, with an effective strategy in place.

Firstly, we’re going to explain what Forex Trading actually is and how it works. We’ll then be examining basic terminology so that you can become accustomed to the words and phrases used while trading foreign exchange. Following the basic terminology, we’re also going to examine the calculations that you’ll be using in your day-to-day life as a forex trader.

Our guide aims to fully equip you with the tools to further your knowledge and understand the details of FX trading before you enter the global markets. If you’ve had some experience with trading Forex before, then feel free to skip ahead to the sections that you’d be interested in. Simply click on the menu titles below to be redirected to the relevant information for you.

Foreign exchange, or Forex for short, is a market where you’re able to exchange one currency for another. With a daily trade volume of $6.6 trillion dollars, the forex market itself is huge! It eclipses the likes of the New York Stock Exchange (NYSE) which, by comparison, has a trading volume of only $22.4 billion per day.The Forex Market’s sheer size attracts a wide range of different participants, including Central Banks, Investment Managers, Hedge Funds, Corporations, Brokers and Retail Traders – with 90% of those market participants being currency speculators!So, what exactly happens in the forex market, to make it so attractive to investors across the globe? Well, imagine that you’d like to exchange one currency for another. You’re effectively selling one currency while buying another, or 'exchanging' it.Now, the exchange rate between those two currencies is what’s important when trading forex. The exchange rate is constantly fluctuating, and it’s these fluctuations that allow market speculators to earn from trading or potentially lose their investment. These fluctuations are driven by the supply and demand of each currency!It’s also important to note at this point that, while you are trading, millions of other traders are also entering the forex market.So, when you 'sell' a currency, there is a buyer for that currency somewhere else. The more people that are trading, the more money there is in the market, which is what we call the 'liquidity'. As we’ve mentioned, the forex market is huge with millions of traders across the globe Because of this the liquidity in the forex market is really high!

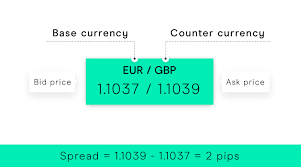

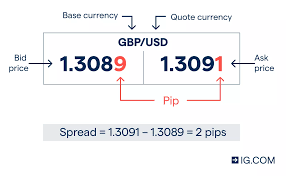

Currencies in the forex market are expressed as pairs. So, lets take a look at the EURUSD and look at what exactly makes up a currency pair.The first thing to know, is that currency pairs are expressed in terms of the 'Base Currency' and the 'Counter Currency'. The base is always expressed first and the counter second – so in our example, the EUR is the base currency and the USD is the counter.Once you’re ready to begin (we’ll get to that a little later in the guide) and are familiar with the platform and want to open your first trade, you’ll see two prices quoted for the EURUSD; the Sell or 'Bid' price, and the Buy or 'Ask' price, as shown below. It’s important to always remind yourself that when you click buy or sell, you’re buying or selling the first currency in the pair.

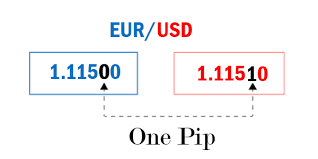

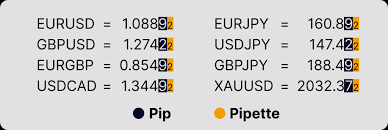

A Pip (Percentage in Point) is the smallest price movement in Forex. For most currency pairs, a pip is 0.0001 (fourth decimal place). For example, a change from 1.2000 to 1.2001 represents a 1-pip movement.

A Pipette is a fractional pip, equal to 0.1 pip. It allows for finer price movements, useful for precise calculations in Forex trading. For instance, 1.20005 includes a pipette (the fifth decimal place).

A Spread is the difference between the bid (selling) price and the ask (buying) price in a currency pair. It represents the cost of trading, typically measured in pips.

Leverage allows traders to control larger positions with smaller capital. For example, 1:100 leverage means you can control $10,000 with $100. Margin is the amount of money required to open a leveraged position. This means that when you’re trading, the profit that you made on a trade is actually amplified because you’re using more money to trade that you have effectively borrowed from you broker. At this point you should be hugely aware that trading with leverage is a double-edge sword. Although your profits may be amplified, your losses are also amplified.Now, to be able to access this type of leverage, your broker will need some for of insurance to enable you to do so. This is where the margin comes in! Think of your margin as a deposit that you give your broker to open and maintain a trade. The broker will effectively keep a portion of your balance to cover the potential loss of your trade.The 'margin requirement' that you broker needs is normally expressed as a percentage of your overall trade and each trade that you open will have one. Remember that your margin requirement will vary depending on the asset that you trade and the broker that you work with.

It’s all about working out the value.The value of each currency depends on the supply and demand for it, thus determining the 'exchange rate' between the two currencies. The exchange rate itself is basically the difference between the value of one currency against another. And, it’s this exchange rate that determines how much of one currency you get in exchange for another, e.g. how many Pounds you get for your Euros.At this point, it’s important to remember that the exchange rate is continually fluctuating.Now, investors involved in currency trading look at many different factors that could potentially affect the value of each currency, and they speculate how these factors will affect the value of those currencies. If a trader thinks that the currency’s value will increase, they’ll buy that currency. Conversely, if they think the value of a currency will decrease, they’ll sell it instead.Now, when you’re trading forex, you’ll be trading currency pairs. So, two different currencies will be involved, and you’ll be speculating about their value in relation to each other.For example, an investor may believe that the value of the Euro will depreciate against the value of the British Pound, because of an imminent data release. So, the investor would sell the Euro, believing its value will fall, and buy the British Pound simultaneously, believing its value will rise. If the investor is correct, then he or she will make a profit!It sounds pretty straightforward right? Well, bear in mind that to speculate effectively you’ll need a good understanding of the market, and knowledge about how to analyse the market movement.